Simple Money Habits That Reduce Stress

Money stress has a way of creeping into everything.

You could be having a perfectly good day — then one small M-Pesa notification sends you spiraling into “how did I spend that much?” territory.

The truth is, most of us aren’t bad with money. We’re just tired. Tired of juggling bills, tired of feeling behind, tired of trying to manage everything without losing our minds.

But calm money habits don’t come from earning more. They come from simplifying how you handle what you already have.

This isn’t about financial perfection — it’s about creating small, sustainable habits that bring a sense of control and peace to your week.

Let’s talk about a few simple money habits that can help you get there.

1. Start with awareness, not judgment

Most of us avoid looking at our spending because we’re afraid of what we’ll find. But awareness is where financial peace begins.

Set aside 10 quiet minutes each Sunday to review your week’s spending. Open your M-Pesa or bank app and note where your money went — without guilt or overthinking.

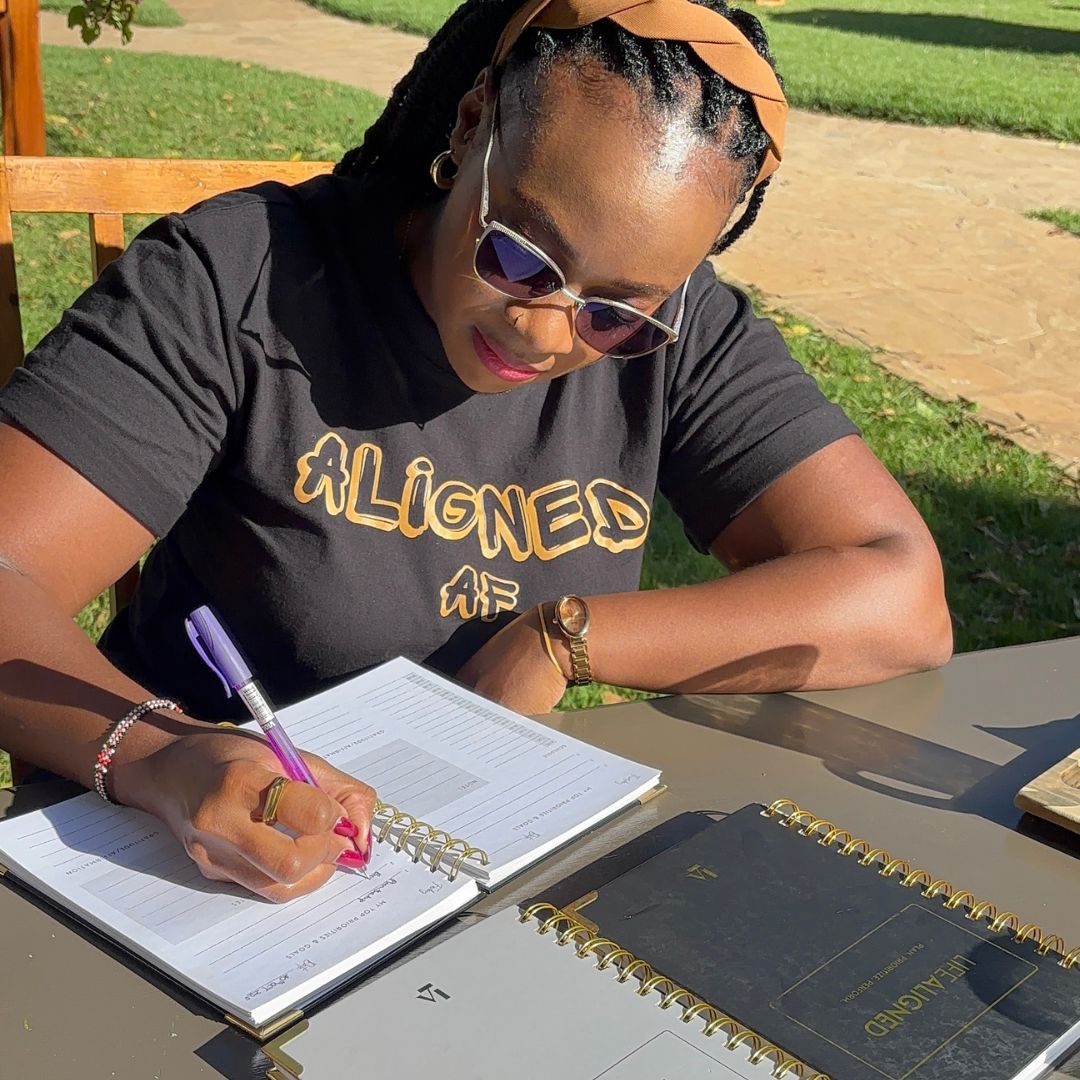

You can record it in your Life Aligned Planner under the notes or reflection section. Over time, you’ll start noticing patterns — the same habits that drain your balance and the ones that keep you grounded.

The goal isn’t to criticize yourself. It’s to understand your flow.

2. Give every shilling a purpose

You don’t need a complex budget — just a plan that makes sense to you.

If you earn Ksh 30,000, decide before it hits your account how it’ll be used: bills, savings, personal spending, and giving.

That simple act of assigning a purpose helps you stay intentional.

Tools like Money254 can help you visualize your spending, but even a paper tracker in your planner works.

Clarity beats complication every time.

3. Build a weekly money ritual

Think of this as your financial “reset.”

Every week — maybe Sunday evening with a cup of tea — take a few minutes to check in with your money.

Look over what you spent last week, note any upcoming payments, and set one financial intention for the week ahead.

It could be:

- “Save 500 bob.”

- “Cook at home twice.”

- “Buy only what’s planned.”

This routine replaces money anxiety with a rhythm you can trust.

4. Separate your spending

If you often find yourself wondering where your money went, separate it.

Use different M-Pesa accounts or mobile wallets for essentials, fun money, and savings. Seeing your money visually divided like this gives you instant clarity and control.

You can also dedicate a page in your Life Aligned Planner to summarize these categories — your “spending snapshot” for the week.

5. Save small, but save often

You don’t need a big salary to start saving — you need consistency.

Start small. Even Ksh 100 a day adds up faster than you think.

What matters is the rhythm, not the amount.

Pick one goal: maybe an emergency fund, a short trip, or a new gadget.

Track it in your planner — color in boxes or mark milestones. It’s a small dopamine hit that makes saving actually enjoyable.

6. Automate peace of mind

If you can, set up automatic transfers for bills and savings.

Automation removes the emotional weight of deciding when or how much to save — it just happens quietly in the background.

And that small layer of predictability brings surprising calm.

7. Reframe how you think about money

Money isn’t just about transactions — it’s about values.

Write a quick gratitude list each week:

- “Paid rent on time.”

- “Had enough for a friend’s gift.”

- “Got home safely every day.”

It’s a simple mindset shift from scarcity to appreciation — and it changes how you approach every shilling you earn.

8. Track your wins

Money growth takes time. So celebrate the small steps.

Record one financial win at the end of each month — even something as small as “I avoided impulse buying” or “I stuck to my budget.”

Progress builds confidence, and confidence makes you consistent.

Your planner can help you stay consistent

The Life Aligned Planner was designed for this kind of mindful living — not just for scheduling tasks.

Use it to reflect on your weekly spending, note your goals, and keep money conversations gentle, not stressful.

Because feeling aligned isn’t about controlling every detail — it’s about creating systems that bring peace into your daily life.

Money calmness doesn’t come overnight, but it does come with intention.

And you deserve that ease.

Final Thought

When it comes to money, start small and stay consistent.

Every small step counts — one mindful purchase, one tracked expense, one saved coin at a time.

That’s what a Life Aligned approach to finances looks like. Not rigid. Not perfect. Just peaceful.